Business Insurance in and around Warr Acres

Calling all small business owners of Warr Acres!

No funny business here

Insure The Business You've Built.

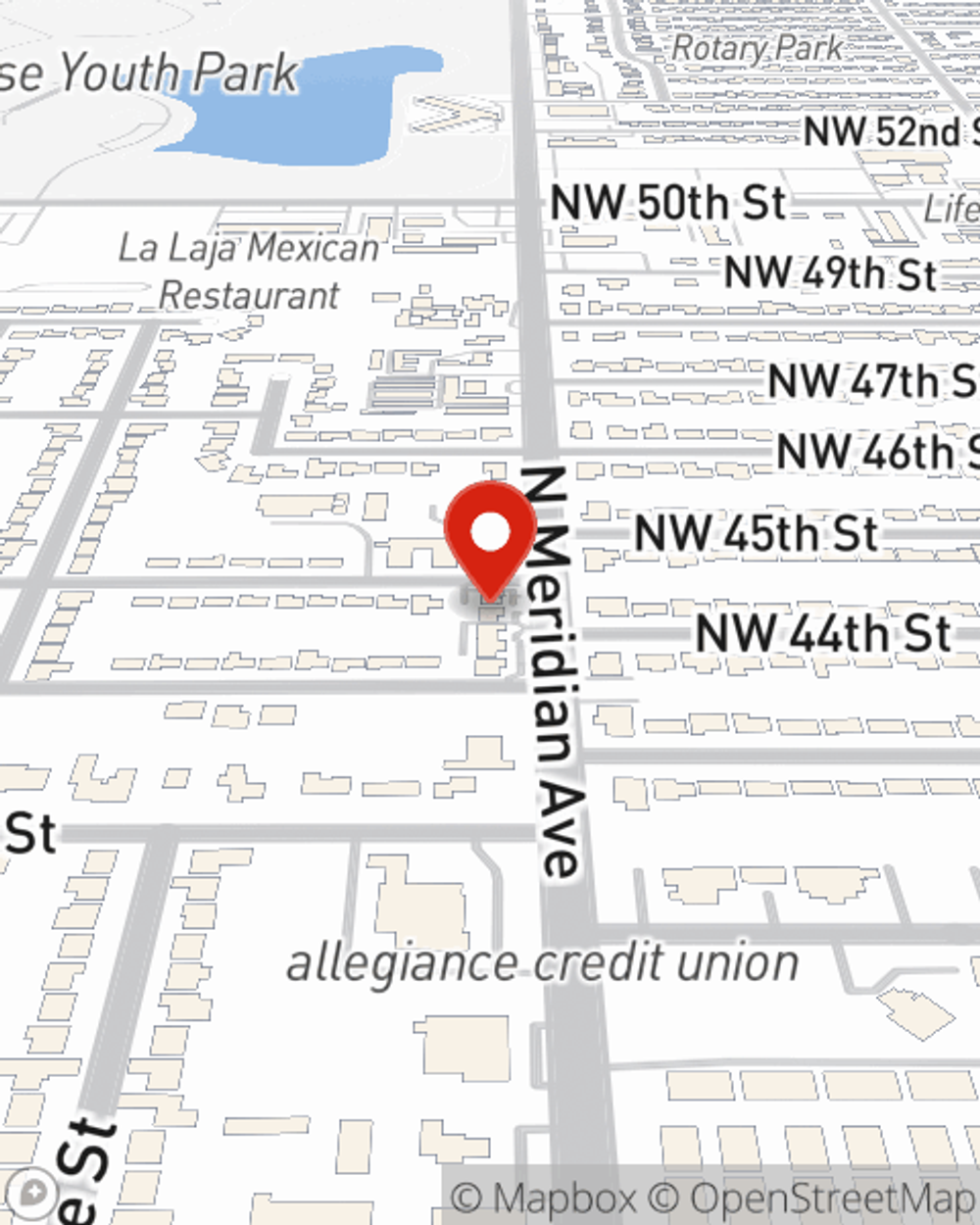

You may be feeling like there is so much to do with running your small business and that you have to handle it all on your own. State Farm agent Brad Russell, a fellow business owner, recognizes the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

Calling all small business owners of Warr Acres!

No funny business here

Customizable Coverage For Your Business

For your small business, whether it's a pet groomer, a fabric store, a bakery, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like accounts receivable, business liability, and computers.

Reach out to State Farm agent Brad Russell today to experience how the trusted name for small business insurance can ease your business worries here in Warr Acres, OK.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Brad Russell

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.